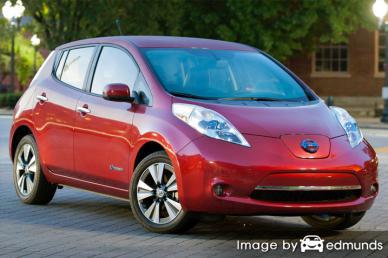

Have you fallen victim to high-priced Nissan Leaf insurance in Albuquerque? You’re preaching to the choir because there are lots of people in the same boat.

Anyone knows that insurance companies don’t want you shop around. Consumers who shop around for cheaper price quotes will most likely switch car insurance companies because they have good chances of finding a more affordable policy premium. Remarkably, a study showed that drivers who routinely shopped for cheaper coverage saved as much as $865 a year compared to people who never compared other company’s rates.

Anyone knows that insurance companies don’t want you shop around. Consumers who shop around for cheaper price quotes will most likely switch car insurance companies because they have good chances of finding a more affordable policy premium. Remarkably, a study showed that drivers who routinely shopped for cheaper coverage saved as much as $865 a year compared to people who never compared other company’s rates.

If finding the most affordable Nissan Leaf insurance is why you’re reading this, learning how to quote and compare coverages can make it easier to shop your coverage around.

Steps to finding the cheapest rates for Nissan Leaf insurance in Albuquerque

The best way we recommend to get affordable auto insurance rates is to annually compare prices from insurers that sell auto insurance in Albuquerque. Drivers can shop around by following these guidelines.

- Take a few minutes and learn about individual coverages and the factors you can control to lower rates. Many rating factors that result in higher prices like distracted driving and bad credit can be rectified by paying attention to minor details. Later in this article we will cover information to prevent rate hikes and find more discounts that you may not know about.

- Compare prices from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only give prices from one company like GEICO or Allstate, while independent agencies can provide price quotes from many different companies.

- Compare the new rate quotes to your existing coverage to see if you can save by switching companies. If you can save money, make sure the effective date of the new policy is the same as the expiration date of the old one.

A good piece of advice is to make sure you enter the same deductibles and limits on every quote and and to get prices from as many different insurance providers as possible. This guarantees a level playing field and a thorough selection of prices.

Companies like State Farm, Farmers Insurance, GEICO and Allstate all promote huge savings with ads and it can be hard to separate fact from fiction and find the best price available.

Best Nissan Leaf insurance rates in New Mexico

The companies shown below are our best choices to provide comparison quotes in Albuquerque, NM. To locate the best cheap auto insurance in NM, we recommend you visit as many as you can to get the most affordable price.

Determine discounts to get cheap Albuquerque insurance rates

The cost of insuring your cars can be expensive, but you can get discounts that many consumers don’t even know exist. Some trigger automatically when you complete an application, but less common discounts must be asked about before they will apply.

- Passive Restraints – Cars that have air bags and/or automatic seat belt systems may earn rate discounts of 20 to 30 percent.

- Military Discounts – Being deployed with a military unit could be rewarded with lower premium rates.

- Own a Home – Owning a house in Albuquerque can earn you a little savings since owning and maintaining a home requires personal responsibility.

- Discount for New Cars – Putting coverage on a new Leaf can get you a discount compared to insuring an older model.

- Distant College Student Discount – Older children who are enrolled in a college that is more than 100 miles from Albuquerque and do not take a car to college may be able to be covered for less.

Drivers should understand that most of the big mark downs will not be given to the entire policy premium. Most only apply to the price of certain insurance coverages like physical damage coverage or medical payments. Even though it appears it’s possible to get free car insurance, companies don’t profit that way.

A partial list of companies that may offer quotes with these benefits are:

Before purchasing a policy, check with every company to apply every possible discount. Some of the discounts discussed earlier may not apply to policies in your area. To see a list of insurance companies who offer discounts in Albuquerque, click this link.

Compare rate quotes but work with a neighborhood Albuquerque auto insurance agent

Many people just prefer to buy from a local agent and doing so can bring peace of mind One of the benefits of comparing rates online is the fact that you can find cheap rate quotes but still work with a licensed agent. Buying insurance from local insurance agents is definitely important in Albuquerque.

To help locate an agent, after submitting this quick form, your information is immediately sent to companies in Albuquerque who will return price quotes for your insurance coverage. It’s much easier because you don’t need to find an agent on your own as quotes are delivered to the email address you provide. You can find lower rates without having to waste a lot of time. If for some reason you want to compare prices for a specific company, you would need to find their quoting web page and fill out their quote form.

To help locate an agent, after submitting this quick form, your information is immediately sent to companies in Albuquerque who will return price quotes for your insurance coverage. It’s much easier because you don’t need to find an agent on your own as quotes are delivered to the email address you provide. You can find lower rates without having to waste a lot of time. If for some reason you want to compare prices for a specific company, you would need to find their quoting web page and fill out their quote form.

If you are wanting to purchase auto insurance from a local Albuquerque insurance agency, it’s helpful to know the different types of agents and how they are distinctly different. Auto insurance agents in Albuquerque can be described as either exclusive or independent (non-exclusive).

Independent Auto Insurance Agencies or Brokers

These type of agents are not restricted to one company so they have the ability to put coverage with a variety of different insurance companies and help determine which has the cheapest rates. If premiums increase, the business is moved internally and you can keep the same agent.

If you are trying to find cheaper rates, you will want to get some free quotes from independent agents to maximize your price options.

Listed below is a list of independent insurance agencies in Albuquerque that can give you competitive price quotes.

J. B. Martin Insurance Agency

8500 Menaul Blvd NE #345 – Albuquerque, NM 87112 – (505) 888-8846 – View Map

Lorraine Y Chavez Insurance Agency, Inc.

8224 Louisiana Blvd NE – Albuquerque, NM 87113 – (505) 821-7123 – View Map

Associated Insurance Professionals, Inc

1429 Carlisle Blvd NE – Albuquerque, NM 87110 – (505) 265-3704 – View Map

Exclusive Agents

These type of agents normally can only provide a single company’s rates and some examples include State Farm, Allstate, or Farmers Insurance. They generally cannot provide prices from multiple companies so they have to upsell other benefits. These agents receive extensive training on their company’s products and that enables them to sell even at higher rates.

Shown below is a list of exclusive insurance agents in Albuquerque willing to provide price quote information.

Francis Harding – State Farm Insurance Agent

4420 4th St NW – Albuquerque, NM 87107 – (505) 242-6231 – View Map

Erin Carnett – State Farm Insurance Agent

10200 Golf Course Rd NW a – Albuquerque, NM 87114 – (505) 898-4273 – View Map

Sam Sample – State Farm Insurance Agent

3700 Osuna Rd NE #514 – Albuquerque, NM 87109 – (505) 341-1000 – View Map

Choosing an auto insurance agent requires more thought than just a low price. These are some questions you should get answers to.

- Are they paid to recommend certain coverages?

- Will vehicle repairs be made with aftermarket parts or OEM replacement parts?

- Is the agent CPCU or CIC certified?

- Do they have any clout with companies to ensure a fair claim settlement?

- Do they see any coverage gaps in your plan?

After receiving good responses to any questions you may have as well as a affordable price, most likely you have located an insurance agent that is reliable enough to insure your vehicles. But keep in mind once you purchase a policy you can cancel your policy whenever you choose to so don’t feel you’re contractually obligated to any specific company for any length of time.

Auto insurance coverage information

Learning about specific coverages of a insurance policy can help you determine the right coverages and the correct deductibles and limits. Policy terminology can be difficult to understand and nobody wants to actually read their policy. Shown next are typical coverage types offered by insurance companies.

Auto liability insurance

Liability coverage protects you from injuries or damage you cause to a person or their property in an accident. Split limit liability has three limits of coverage: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You might see policy limits of 25/50/10 that translate to $25,000 in coverage for each person’s injuries, $50,000 for the entire accident, and property damage coverage for $10,000. Another option is a combined single limit or CSL which limits claims to one amount rather than limiting it on a per person basis.

Liability coverage protects against things such as repair bills for other people’s vehicles, attorney fees and repair costs for stationary objects. How much liability coverage do you need? That is your choice, but it’s cheap coverage so purchase higher limits if possible. New Mexico state minimum liability requirements are 25/50/10 but it’s recommended drivers buy more coverage.

The chart below demonstrates why the minimum limit may not be high enough to adequately cover claims.

Comprehensive coverage

Comprehensive insurance will pay to fix damage caused by mother nature, theft, vandalism and other events. You need to pay your deductible first then your comprehensive coverage will pay.

Comprehensive insurance covers things like hitting a bird, vandalism, hail damage, theft and a tree branch falling on your vehicle. The maximum payout your insurance company will pay is the market value of your vehicle, so if the vehicle’s value is low consider removing comprehensive coverage.

Uninsured/Underinsured Motorist coverage

This coverage provides protection when other motorists are uninsured or don’t have enough coverage. Covered losses include hospital bills for your injuries and also any damage incurred to your Nissan Leaf.

Due to the fact that many New Mexico drivers have only the minimum liability required by law (which is 25/50/10), their liability coverage can quickly be exhausted. That’s why carrying high Uninsured/Underinsured Motorist coverage is important protection for you and your family. Most of the time your uninsured/underinsured motorist coverages are identical to your policy’s liability coverage.

Collision coverage

This coverage pays for damage to your Leaf from colliding with another car or object. You will need to pay your deductible then your collision coverage will kick in.

Collision coverage pays for things like scraping a guard rail, crashing into a building, crashing into a ditch and hitting a mailbox. Collision coverage makes up a good portion of your premium, so you might think about dropping it from vehicles that are older. Drivers also have the option to bump up the deductible on your Leaf to bring the cost down.

Medical payments coverage and PIP

Med pay and PIP coverage kick in for expenses for prosthetic devices, rehabilitation expenses, X-ray expenses, ambulance fees and pain medications. The coverages can be used to fill the gap from your health insurance plan or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and also covers being hit by a car walking across the street. Personal injury protection coverage is not available in all states and may carry a deductible

Compare. Compare. Compare.

Some insurance providers do not provide online rate quotes and most of the time these regional carriers work with independent agents. Discount Nissan Leaf insurance is attainable online and from local insurance agents, so you need to compare both in order to have the best price selection to choose from.

As you go through the steps to switch your coverage, never buy lower coverage limits just to save a few bucks. There are a lot of situations where an insured dropped physical damage coverage and discovered at claim time they didn’t purchase enough coverage. The goal is to get the best coverage possible at the lowest possible cost, but do not sacrifice coverage to save money.

Steps to finding low-cost Nissan Leaf insurance in Albuquerque

The most effective way to get affordable Nissan Leaf insurance in Albuquerque is to compare quotes once a year from insurance carriers who sell insurance in New Mexico. This can be done by completing these steps.

- Learn about the different coverages in a policy and the factors you can control to lower rates. Many risk factors that result in higher prices like careless driving and your credit history can be rectified by making lifestyle changes or driving safer.

- Quote rates from direct carriers, independent agents, and exclusive agents. Direct companies and exclusive agencies can only provide price estimates from a single company like GEICO or State Farm, while agents who are independent can provide rate quotes from multiple insurance companies. Compare rates now

- Compare the price quotes to your existing coverage and determine if cheaper Leaf coverage is available. If you find a better price and decide to switch, make sure there is no coverage gap between policies.

A good tip to remember is that you use the same deductibles and limits on each quote and and to get price estimates from as many companies as possible. Doing this helps ensure the most accurate price comparison and a thorough selection of prices.

Additional articles

- Teen Driving Statistics (GEICO)

- Winter Driving (Insurance Information Institute)

- Tools for Teen Driving Safety (State Farm)

- Auto Insurance for Teen Drivers (Insurance Information Institute)