It goes without saying that auto insurance companies don’t want you shop around. Drivers who compare other prices are very likely to switch companies because they have a good chance of finding good coverage at a lower price. A recent survey found that consumers who routinely shopped for cheaper coverage saved $72 a month as compared to drivers who never compared other company’s rates.

It goes without saying that auto insurance companies don’t want you shop around. Drivers who compare other prices are very likely to switch companies because they have a good chance of finding good coverage at a lower price. A recent survey found that consumers who routinely shopped for cheaper coverage saved $72 a month as compared to drivers who never compared other company’s rates.

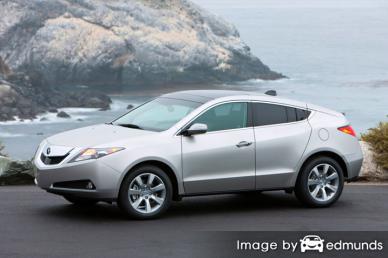

If finding the cheapest rates on Acura ZDX insurance is your ultimate goal, understanding the best ways to find and compare coverages can save time and make the process easier.

To save the most money, the best way to find low-cost car insurance rates in Albuquerque is to start doing an annual price comparison from insurance carriers in New Mexico. Rates can be compared by following these steps.

- Gain an understanding of how companies set rates and the measures you can control to keep rates in check. Many risk factors that cause rate increases like accidents, traffic tickets, and a less-than-favorable credit score can be eliminated by making minor driving habit or lifestyle changes. Continue reading for more information to find cheap prices and find additional discounts you may qualify for.

- Get rate quotes from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can give quotes from one company like GEICO or Allstate, while independent agents can give you price quotes from many different companies.

- Compare the quotes to your existing policy and determine if cheaper ZDX coverage is available in Albuquerque. If you find better rates and decide to switch, make sure there is no coverage gap between policies.

- Give proper notification to your current agent or company of your intent to cancel the current policy. Submit the required down payment along with the signed application to your new company or agent. As soon as you have the new policy, put the proof of insurance certificate in your glove compartment.

One thing to point out is to make sure you enter similar deductibles and liability limits on every price quote and and to get rate quotes from as many car insurance companies as possible. Doing this enables an apples-to-apples comparison and the most accurate and complete price analysis.

Choosing the most cost-effective car insurance policy in Albuquerque is really quite easy. If you have car insurance now, you will surely be able to find better prices using these tips. But New Mexico car owners must know how companies calculate your car insurance rates because rates fluctuate considerably.

To find affordable Acura ZDX insurance quotes, there are several ways to get quotes from many auto insurance companies in New Mexico. The easiest way by far to find cheaper Acura ZDX rates is to get quotes online.

It’s important to know that getting more free quotes increases your odds of finding the best price.

The companies shown below can provide price quotes in Albuquerque, NM. To buy the best auto insurance in New Mexico, we recommend you visit two to three different companies in order to find the lowest rates.

Save a ton with discounts

Not many people think insurance is cheap, but there may be some discounts to cut the cost considerably. Some of these discounts will be visible at the time of quoting, but some may not be applied and must be asked for prior to getting the savings.

- Early Payment Discounts – If you pay your bill all at once instead of paying each month you may reduce your total bill.

- Good Grades Discount – Excelling in school can be rewarded with saving of up to 25%. Earning this discount can benefit you until age 25.

- Sign Online – A few auto insurance companies give back up to $50 shop Albuquerque auto insurance online.

- Driver Training Discounts – Taking time to complete a class that teaches defensive driving techniques could possibly earn you a 5% discount if your company offers it.

- No Charge for an Accident – Not really a discount, but a few companies such as Allstate and State Farm will let one accident slide without raising rates so long as you are claim-free before the accident.

- ABS and Traction Control Discounts – Vehicles that have anti-lock braking systems are much safer to drive and will save you 10% or more on ZDX insurance in Albuquerque.

- Multi-Vehicle Discounts – Buying a policy with multiple cars or trucks with the same company could earn a price break for each car.

- Military Discounts – Having an actively deployed family member can result in better auto insurance rates.

It’s important to understand that most discount credits are not given to the entire cost. A few only apply to specific coverage prices like liability and collision coverage. If you do the math and it seems like you would end up receiving a 100% discount, nobody gets a free ride. But any discount will definitely reduce your auto insurance premiums.

The chart below illustrates the comparison of Acura ZDX annual premium costs with and without some available policy discounts. The prices are based on a female driver, a clean driving record, no claims, New Mexico state minimum liability limits, comp and collision included, and $1,000 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with claim-free, multi-car, safe-driver, multi-policy, homeowner, and marriage discounts applied.

To choose insurers with the best Acura ZDX insurance discounts in Albuquerque in New Mexico, click here.

Detailed insurance information

The table shown below highlights detailed analysis of insurance costs for Acura ZDX models. Being able to understand how insurance quotes are established can be valuable when making informed decisions when shopping around for a new policy.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| ZDX Technology Package AWD | $242 | $450 | $338 | $20 | $102 | $1,152 | $96 |

| ZDX AWD | $242 | $450 | $338 | $20 | $102 | $1,152 | $96 |

| ZDX Advance Package AWD | $242 | $508 | $338 | $20 | $102 | $1,210 | $101 |

| Get Your Own Custom Quote Go | |||||||

Premium data assumes married female driver age 40, no speeding tickets, no at-fault accidents, $500 deductibles, and New Mexico minimum liability limits. Discounts applied include multi-vehicle, safe-driver, claim-free, homeowner, and multi-policy. Price estimates do not factor in Albuquerque location which can increase or decrease coverage rates greatly.

The illustration below shows how choosing a deductible and can affect Acura ZDX premium costs for each different age group. The premiums are based on a single female driver, comp and collision included, and no policy discounts are applied.

Price comparison of only insuring for liability

The information below shows the difference between Acura ZDX auto insurance costs with full coverage compared to only the New Mexico minimum liability coverage. The costs are based on no claims or driving citations, $500 deductibles, drivers are single, and no discounts are applied.

When to switch to liability coverage only

There is no definitive rule of when to exclude full coverage on your policy, but there is a guideline you can use. If the yearly cost of full coverage is 10% or more of the replacement cost minus the deductible, then it might be time to consider dropping full coverage.

For example, let’s pretend your Acura ZDX book value is $4,000 and you have $1,000 policy deductibles. If your vehicle is totaled, the most your company would pay you is $3,000 after the deductible is paid. If it’s costing in excess of $300 annually for physical damage coverage, then you may want to consider only buying liability coverage.

There are some cases where eliminating full coverage is not a good plan. If you haven’t satisfied your loan, you have to keep full coverage in order to prevent your loan from defaulting. Also, if your savings is not enough to buy a different vehicle if your current one is in an accident, you should keep full coverage on your policy.

Seven Things That Determine Your Insurance Costs

One of the most helpful ways to save on insurance is to to have a grasp of some of the elements that help calculate your insurance rates. When you understand what controls the rates you pay, this enables informed choices that could help you find lower insurance prices. Multiple criteria are used when pricing auto insurance. Some factors are common sense like a motor vehicle report, although others are less apparent like your continuous coverage or how financially stable you are.

The list below includes a few of the things companies use to determine your premiums.

- Save money by having multiple policies – Many companies will award a discount for people who carry more than one policy in the form of a multi-policy discount. This can amount to as much as ten percent or more Even with this discount applied, it’s in your best interest to compare Acura ZDX rates in Albuquerque to help ensure you have the lowest rates. Drivers may still find better rates by splitting coverages up.

- Cars with good safety ratings save money – Safe vehicles are cheaper to insure. Vehicles engineered for safety have better occupant injury protection and reduced instances of injuries translates into fewer and smaller insurance claims which can mean better rates for you. If the Acura ZDX scored at minimum an “acceptable” rating on the Insurance Institute for Highway Safety website it may cost less to insure.

-

Driving citations can increase costs – Being a careful driver impacts your car insurance rates tremendously. Only having one speeding ticket can increase rates to the point where it’s not affordable. Drivers with clean records get better prices than their less careful counterparts. Drivers who have gotten careless violations like reckless driving, hit and run or driving under the influence may find that they have to to submit a SR-22 form to the state department of motor vehicles in order to legally drive.

The example below demonstrates how speeding tickets and fender-benders can increase Acura ZDX premium costs for different age groups. The rates are based on a single female driver, full physical damage coverage, $250 deductibles, and no discounts are taken into consideration.

-

Gender and insurance coverage rates – Over time, data shows that men are more aggressive behind the wheel. Now that doesn’t mean women are better drivers. Men and women cause at-fault accidents at a similar rate, but the men tend to have more serious accidents. Men also statistically receive more major tickets such as driving while intoxicated (DWI) or driving recklessly. Male drivers age 16 to 19 cause the most accidents and therefore have the most expensive insurance rates.

The diagram below visualizes the comparison of Acura ZDX insurance costs for male and female drivers. The premium estimates are based on no accidents or driving violations, comprehensive and collision coverage, $100 deductibles, single status, and no discounts are taken into consideration.

- Insurance rates for married couples – Your spouse actually saves money on insurance. Having a significant other may mean you are more responsible and statistics prove drivers who are married are more cautious.

- Insurance rates in urban areas – Being located in less populated areas of the country has definite advantages if you are looking for the lowest rates. Less people means less chance of accidents and lower theft and vandalism rates. People who live in big cities regularly have more auto accidents and longer commute times. More time on the road statistically corresponds to a higher accident and claim rate.

- Lower physical damage deductibles cost more – Physical damage protection, termed comprehensive and collision coverage on your policy, is used to repair damage to your vehicle. Examples of some claims that would be covered are a windshield shattered by a rock, collision with an animal, and rolling your vehicle. Comp and collision deductibles are the amount of money you are willing to pay if the claim is covered. The more of the claim you’re willing to pay, the less your insurance will be.